Let’s look into this

Despite the obvious fundamental demand for bitcoin (Tesla, Microstrategy, Square, Walmart, just to name a few instituions who have bought bitcoin), and the impending bitcoin halving coming at the end of 2023, or early 2024 where the block rewards for bitcoin miners will be cut in half

A lot of researchers are looking into Bitcoin technical analysis for bitcoin, trying to analyze where the intermediate term top will be

some people are looking at things like the RSI in the MACD

many people are saying that the technicals are showing the price is overextended and is nearing a top

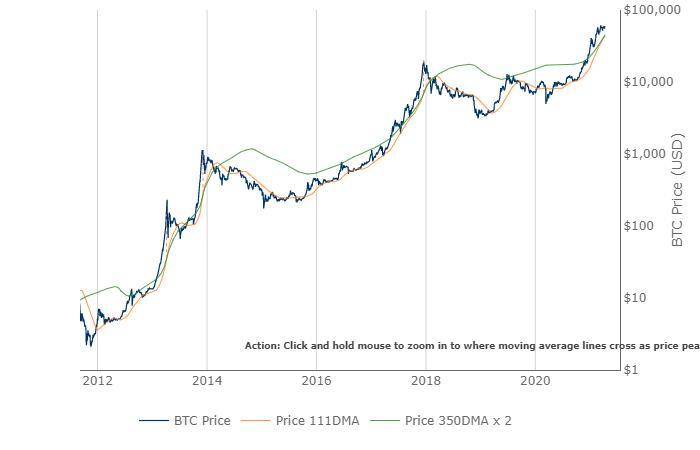

one particular technical indicator that has stuck out to me was the pi cycle indicator

in the past the pi cycle indicator has been extremely useful at pointing out an intermediate term top

the pi cycle indicator has only crossed over 3 times in the past 5 years

when the pi cycle indicator has crossed over, it typically indicates a top

the last 2 time have resulted in sell off’s lasting months, and sometimes years.

this time may or may not result in a sell off

it’s just one of many indicators I like to use my trading

lets look at the pi cycle indicator

The pi cycle indicator is flashing a bearish signal, the 350 dma has crossed below the 111dma

I’m also a big fan of the MRI indicator as i find it useful in finding near term tops , especially when trading an asset that is approaching an all time high. (for more information about the MRI indicator, visit tonevays.com or visit his youtube channel)

All time highs of any asset class can be difficult to chart using typical indicators because it’s difficult to find a resistance level when the price has not gone to that level yet .some people like to use Fibonacci ,but I find macd , pi cycle, and stochastic oscillator more useful.

For more information about resistance levels of bitcoin visit barchart.com

investopedia.com also has detailed information about most of the indicators i have mentioned.

Here at smash blockchain we suggest using your own due diligence before making a trade , if necessary , use risk management, stop losses ETC, and never use leverage, if you do so you’re doing so at your own risk!

None of this is investment advice,

This is for informational and education purposes only.

At the time of this post smash blockchain and it’s editors have no position in any of the aforementioned assets