In brief

- Goldman Sachs, one of the biggest investment banks, will offer Ethereum futures and options trading in the coming months.

- The move comes after the bank embraced Bitcoin earlier this year.

Investment bank Goldman Sachs plans to offer options and futures trading in Ethereum “in the coming months,” an executive told Bloomberg.

The move comes four months after Goldman reopened its crypto trading desk and started offering Bitcoin futures contracts

Futures contracts in crypto are deals that let people buy cryptocurrencies at a predetermined date in the future. They are bets on the future price of the crypto asset; for example, if you think that the price of Ethereum will go up, snapping up futures at today’s price of $2,560 could net you a profit.

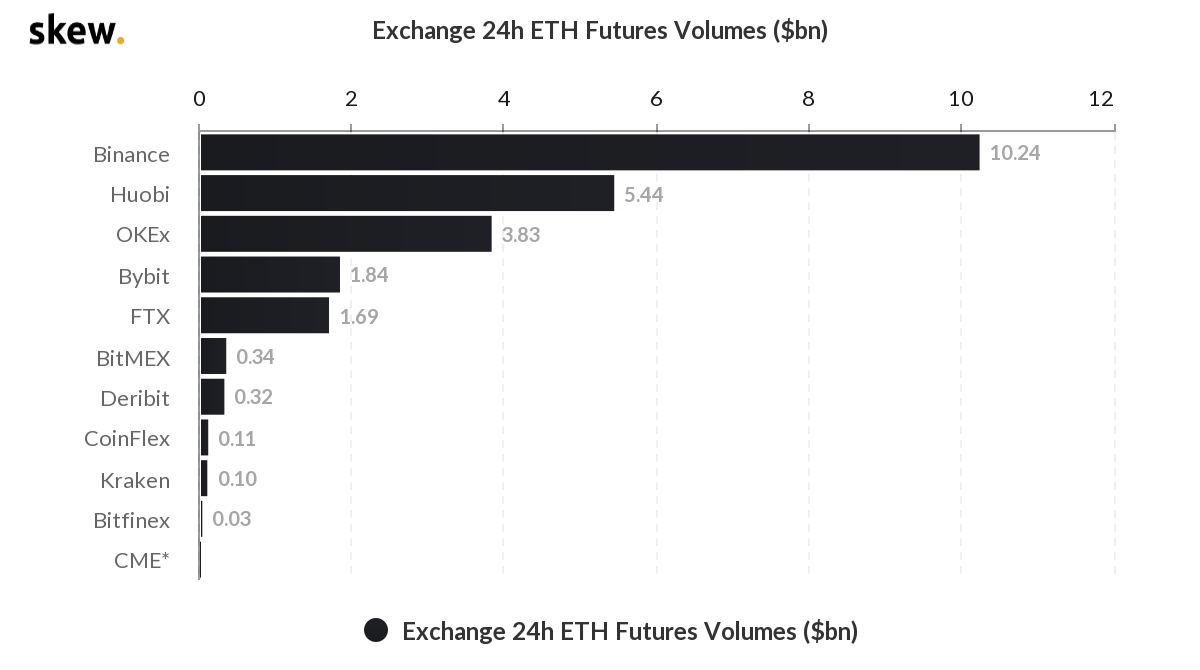

Futures contracts are often bought and sold like any market-traded asset because the difference between the contract price at the time of signing and the real market price at that given future date offers a betting opportunity. The Ethereum futures market record a daily volume of $23.9 billion, as per data from market analytics firm Skew.

Likewise, options contracts give traders a chance—but not the obligation, unlike futures contracts—to buy crypto at a set price and can typically be traded up until the last Friday of each month. According to data from Skew, the Ethereum options market has a daily volume of $6.1 billion.

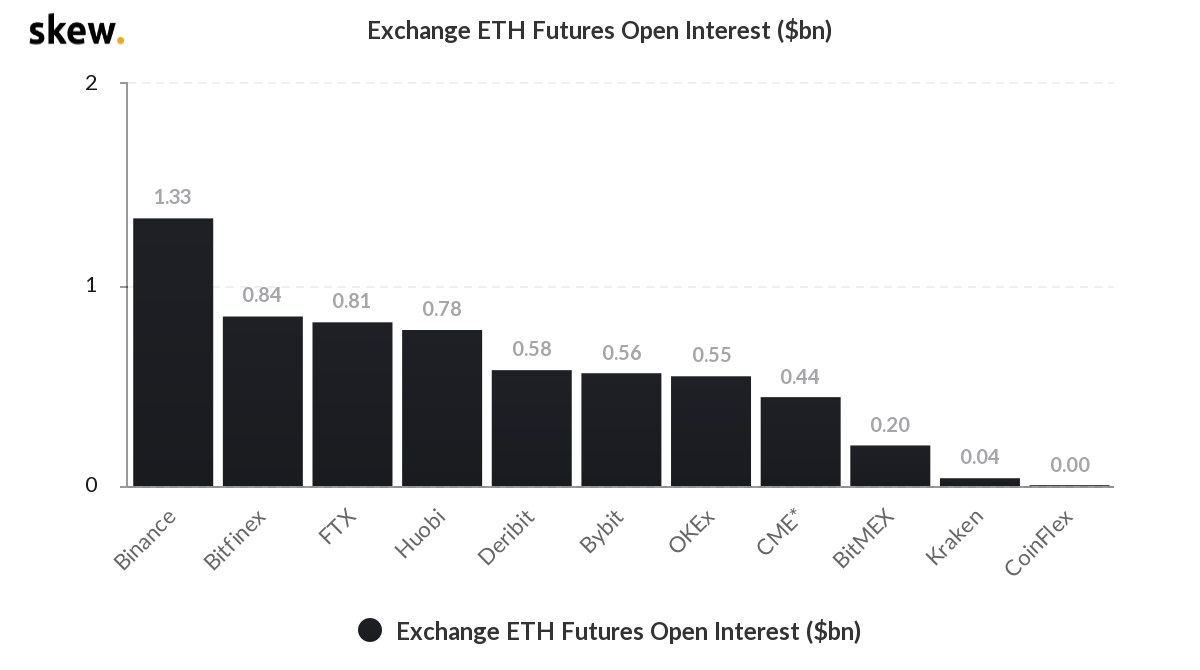

“The main thing here is that Goldman finally capitulated” to the demand for Ethereum derivatives products, a fund manager at a large crypto fund who wished not to be named told Decrypt. Goldman’s entry into the ETH options and futures game will add liquidity to the market, which is good news for current traders.

Goldman’s move could also be viewed as good news for those of its clients who aren’t put off by the current market slump and its implications for crypto’s future—and there are many of them, according to Mathew McDermott, head of digital assets at Goldman.

“We’ve actually seen a lot of interest from clients who are eager to trade as they find these levels as a slightly more palatable entry point,” Mathew McDermott, head of digital assets at Goldman, told Bloomberg. “We see it as a cleansing exercise to reduce some of the leverage and the excess in the system, especially from a retail perspective.”

Goldman and Bitcoin

Goldman’s move into Ethereum derivatives products comes after the bank embraced Bitcoin earlier this year.

Goldman, which didn’t consider Bitcoin a legitimate asset class last year, changed its position in May, calling it an “investable asset” with its “own idiosyncratic risk, partly because it’s still relatively new and going through an adoption phase.”

“But clients and beyond are largely treating it as a new asset class, which is notable—it’s not often that we get to witness the emergence of a new asset class,” the bank noted at the time.

In March, Goldman filed an application to the U.S. Securities and Exchange Commission (SEC) for an investment product that could expose clients indirectly to Bitcoin. The product—a linked note, or an income-producing product tied to a security or basket or securities, like an ETF—will track the ARK Innovation ETF, which has a large investment in Grayscale Bitcoin Investment Trust.

Earlier this month, however, Goldman Sachs’ chief of commodities said he considers Bitcoin to be “digital copper,” since it is similarly volatile and shares similar risk characteristics, making it unsuitable for safely preserving capital. Ardent Bitcoin investors consider Bitcoin to be “digital gold,” a safe long-term investment.