Our team of researchers surveyed 1,273 active cryptocurrency traders on what would happen if Binance, the world’s largest crypto exchange, failed. This poll aimed to gauge sentiment on the impacts a Binance collapse would have on the broader crypto ecosystem.

With over $5.7 billion in daily trading volume, Binance accounts for half of all crypto trades globally. But critics have highlighted regulatory troubles, concentration risk, and doubts over the reserves backing Binance’s BNB token.

This poll provides a vital health check on market confidence by exploring how traders foresee a Binance collapse impacting bitcoin’s price, DeFi, regulation, and adoption. With crypto booming, Binance’s health has wide implications, so we aim to illuminate a worst-case scenario and highlight how much the industry relies on the exchange. The survey is a barometer for market confidence if the unthinkable happened to this titan exchange.

Key Takeaways at a Glance

- 45% of traders see Binance failure as a credible risk due to regulation/competition

- 55% believe Binance will maintain dominance despite challenges

- 60% say Binance collapse would cause market crisis and volatility

- 40% think it would spur competition and innovation

- 70% expect a significant Bitcoin price crash if Binance failed

- 30% believe the Bitcoin price would remain stable

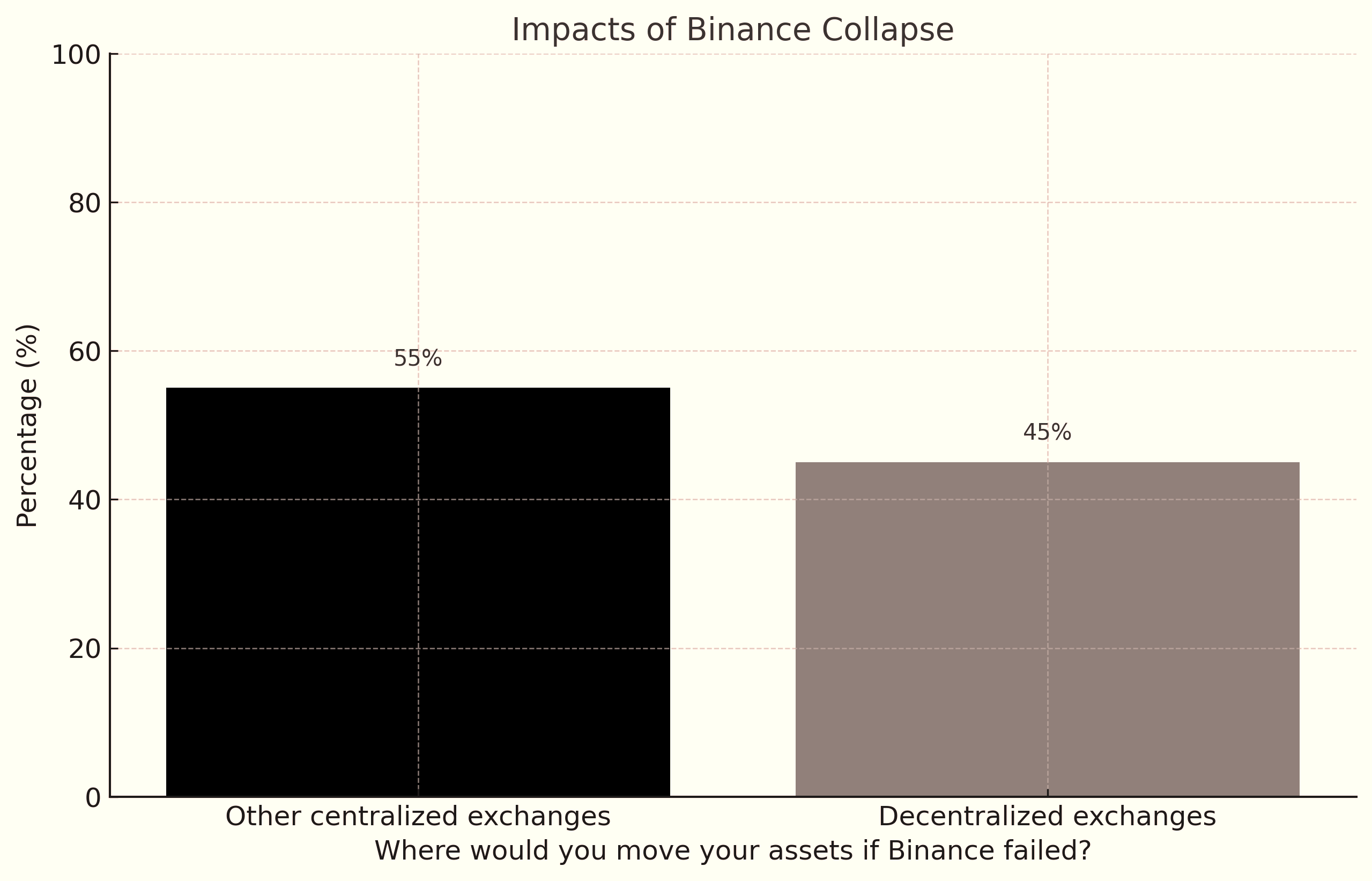

- 55% would migrate to centralized exchanges like Coinbase if Binance failed

- 45% would switch to decentralized exchanges

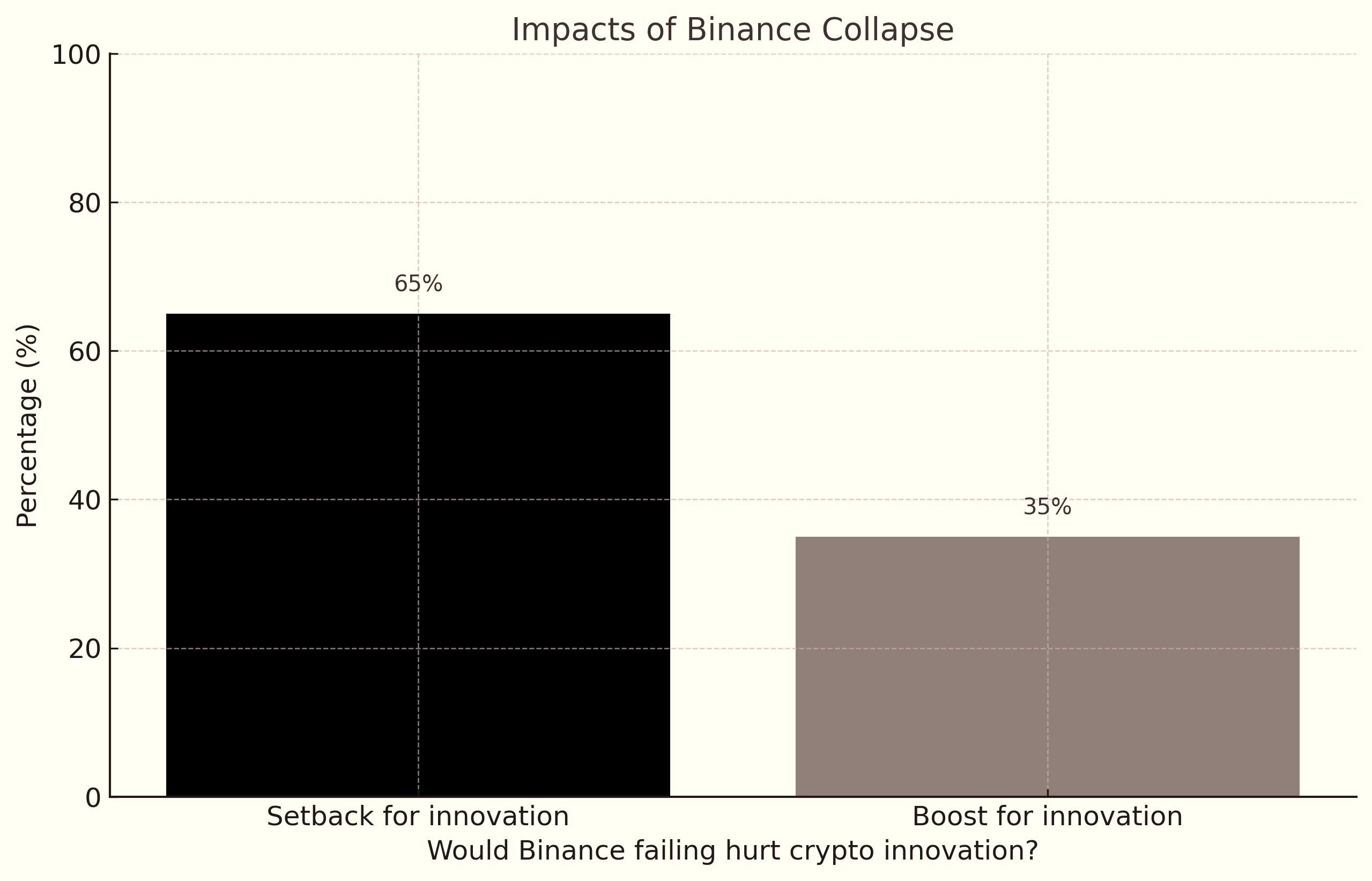

- 65% say Binance failure would hinder innovation and growth

- 35% think it could unlock new opportunities

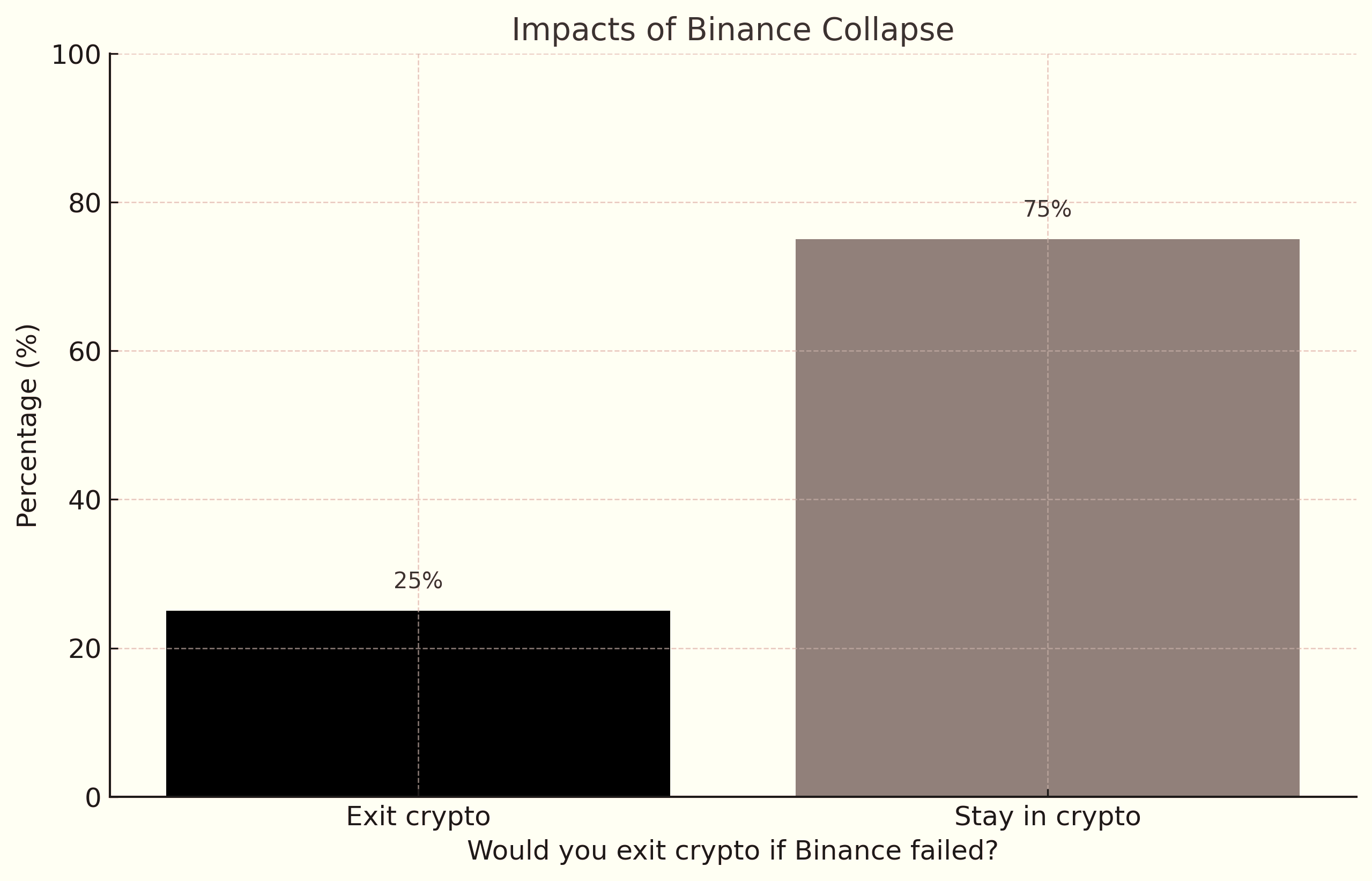

- 75% would remain in crypto market even if Binance collapsed

- 25% would consider exiting crypto, at least temporarily

Survey Methodology

Our research team deployed a survey methodology to query a representative sample of cryptocurrency traders. The online survey was conducted in July 2023 in collaboration with our data provider to carefully survey a representative sample of 1,273 cryptocurrency traders internationally.

The sizable sample enables detailed breakdowns across demographics. Respondents skewed male at 72% compared to 24% female. In terms of age, 70% were millennials or younger, while 30% were over 35.

Geographically, the largest share were from the US at 31%, followed by Europe, India, UK, Canada, Australia and China. The survey reached experienced traders – 77% have traded crypto for over 1 year. This means insights come from those who have navigated multiple market cycles.

In terms of trading activity, 79% trade at least weekly, while 21% take a longer-term approach. The sample captures diverse trading timeframes. Finally, 54% classified themselves as non-retail, implying a mix of individual and professional/institutional traders.

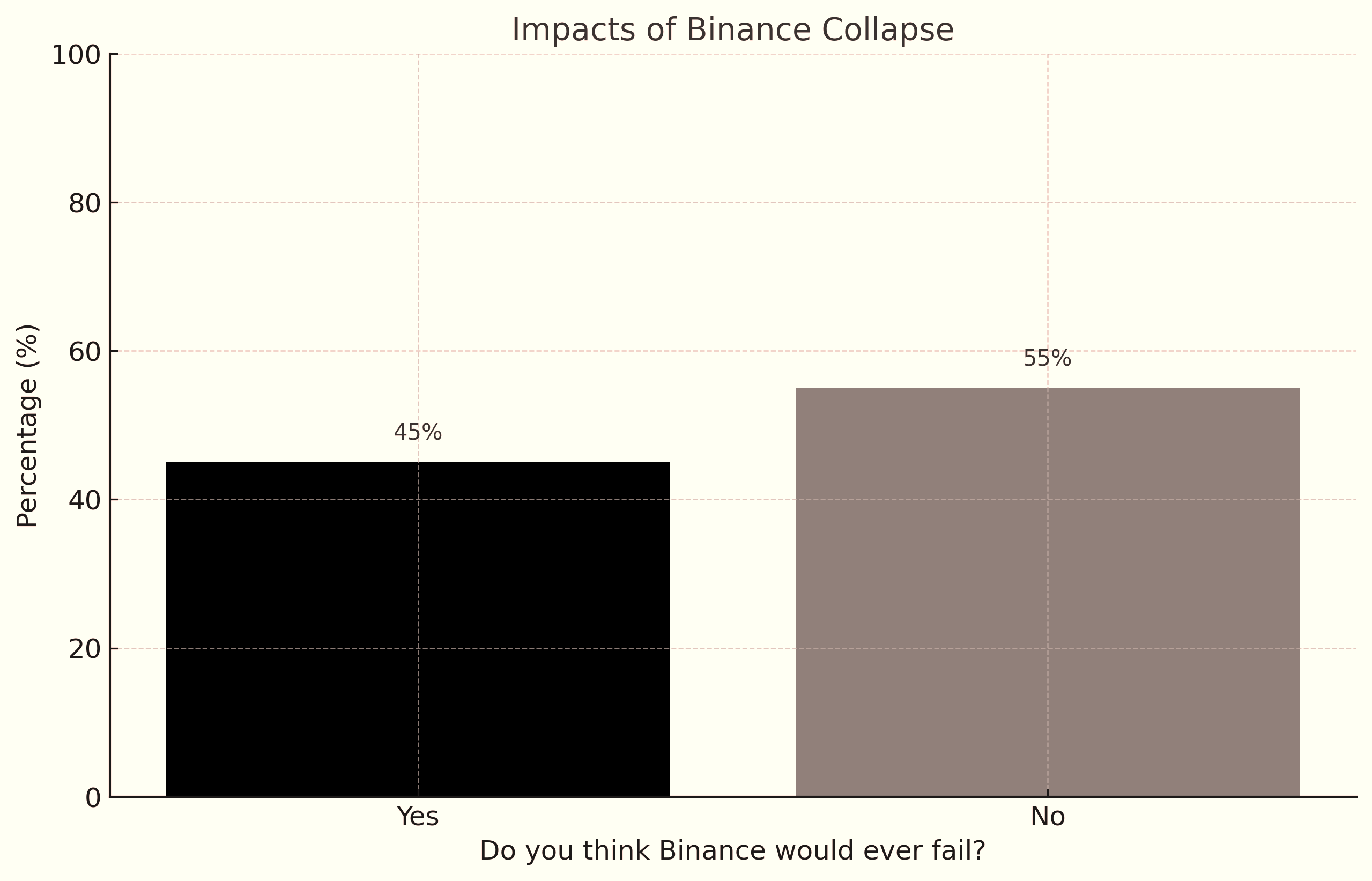

45% Think Binance Could Go Down, 55% Believe It Will Remain the Leader

Our survey found opinions split, with neither an optimistic nor pessimistic outlook prevailing clearly.

45% of respondents believe the potential for Binance failing in the foreseeable future is credible. This cohort points to regulatory troubles and intensifying competition as major threats. Binance has confronted tighter restrictions from national regulators worldwide, including the US, UK, and Canada. These actions raise uncertainty around its long-term viability.

If decentralized exchanges continue to evolve, Binance could lose its competitive edge. The emergence of central bank digital currencies (CBDCs) may also diminish the appeal of private crypto assets.

On the flip side, 55% are confident Binance will maintain dominance. They believe regulatory risks are overblown and Binance has the resources and leadership to adapt. Its acquisition of regulatory licenses in restricted jurisdictions demonstrates dedication to compliance.

This group also points to the strength of Binance’s liquidity pool, embedded user base, and the brand’s global clout. Network effects make rival exchanges struggle to match Binance’s depth. Even with revenue dipping amid the recent bear market, Binance still generated $7 billion profit in 2022. Its financial muscle ensures it can weather downturns.

So while risks are apparent, over half of traders still view Binance as virtually unassailable given its scale and gravitas in crypto. Yet a sizeable minority sees red flags around regulation and competition. This split in perceptions suggests the market is somewhat polarized on just how durable Binance’s dominance can prove if macro conditions worsen. Its failure is far from a consensus view, but nor is it unthinkable.

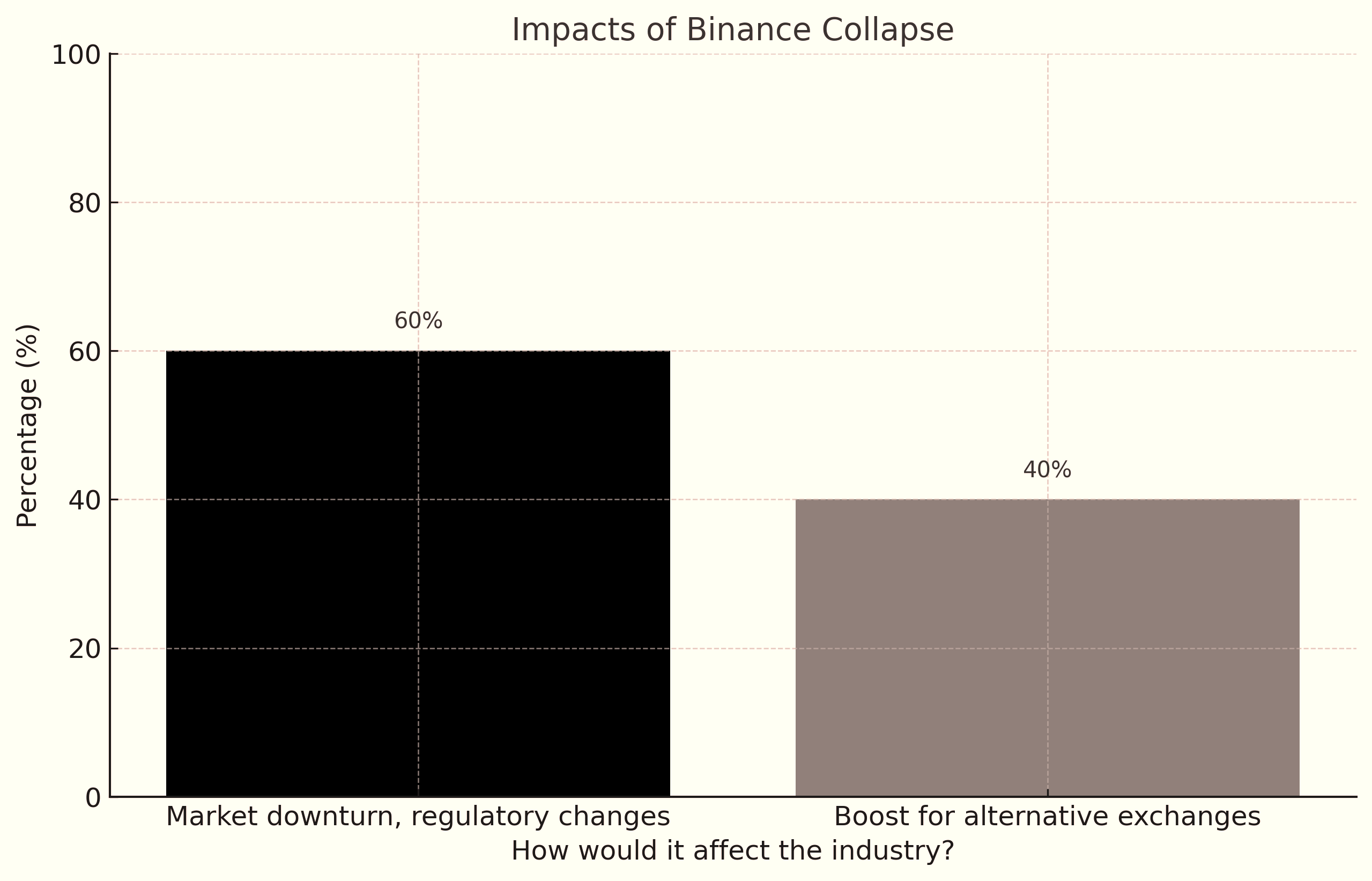

60% Warn Binance Collapse Would Crash Crypto, 40% Predict Adaptation

The sheer scale of Binance means its potential downfall would send shockwaves through the crypto industry. But would the reverberations be catastrophic or simply spur healthy adaptation? Traders expressed mixed views on the wider implications.

A majority of 60% warned a Binance failure would severely undermine market stability and confidence. This pessimistic group believes the sudden loss of 50% of global trading volume and Binance’s liquidity pool would trigger severe volatility and price crashes for bitcoin and altcoins.

With Binance intricately linked to arbitrage, derivatives, and stablecoins markets, its collapse would create dangerous systemic contagion. The viability of USDT, crypto’s most traded stablecoin and a foundational cog in the market, could be thrown into question without Binance as its chief venue.

These respondents also predict Binance’s failure would lead to hurried new regulations possibly banning retail investors from crypto or mandating exchange reserves. Market turbulence could prompt interventionist policies that restrict innovation in blockchain and digital assets.

On the flip side, 40% insist Binance going under would produce positive creative destruction that unshackles the market from overreliance on one dominant player. In their view, demand would migrate to alternatives, spurring healthy competition and innovation.

Exchange rivals and decentralized alternatives would gain market share, ending Binance’s de facto monopoly. This fragmentation would enable greater optionality and choice for traders while enhancing resilience.

“If Binance went under, it would be a massive shock, but I don’t think it would be fatal for crypto. Other exchanges would pick up the slack and we’d see innovation in decentralized finance accelerate.”

While perspectives differ on the severity of impacts, most agree a Binance collapse would make history as crypto’s largest crisis to date. Even with optimism that the market would adapt long-term, the short-term whiplash from the swift loss of its main artery would be unavoidable.

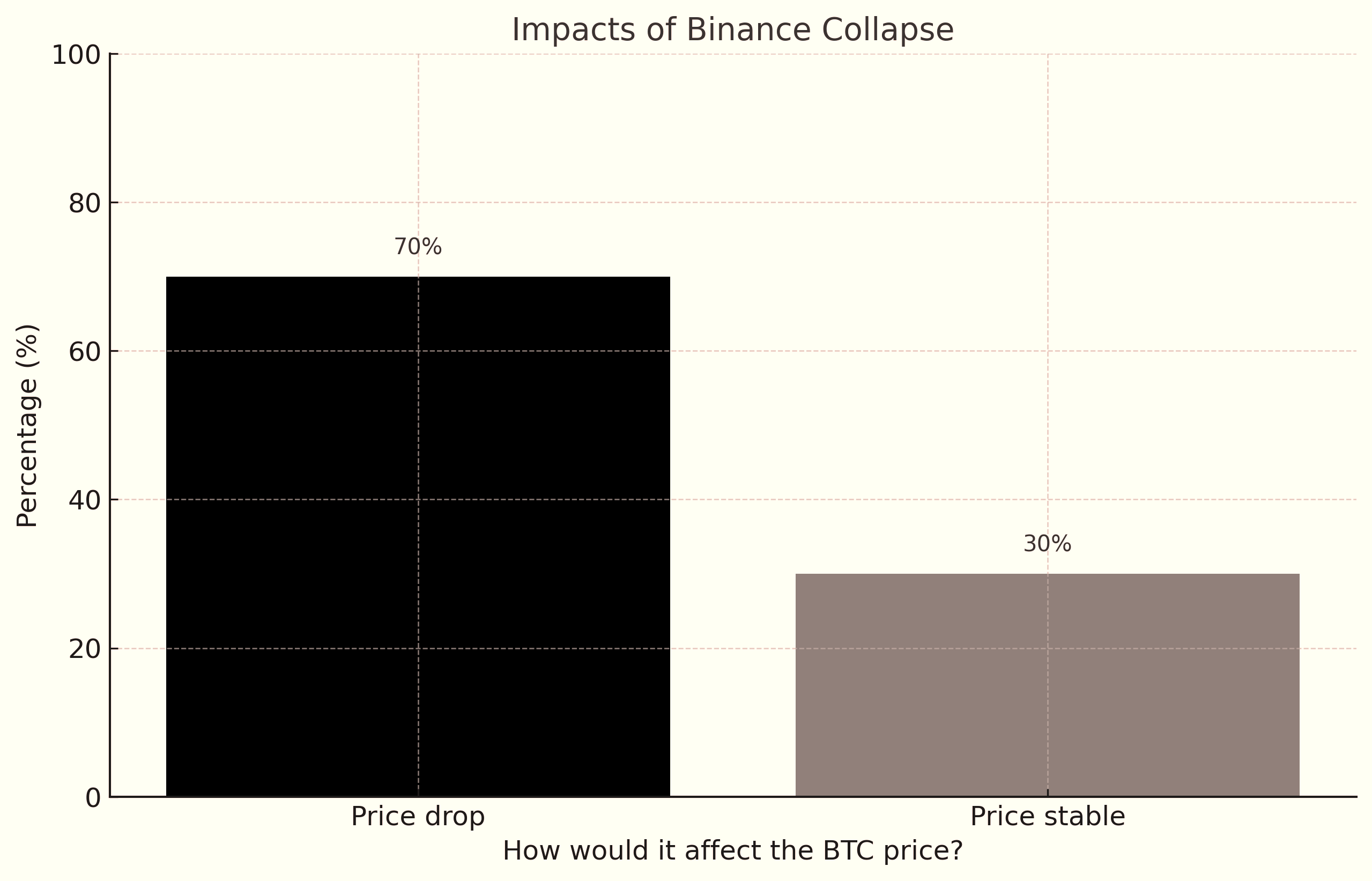

70% Say Binance’s End Would Slam Bitcoin’s Price, 30% See Limited Impact

As the most prominent crypto asset, Bitcoin’s price reaction would underline the severity of Binance going offline. So how do traders foresee the flagship cryptocurrency responding to the loss of the sector’s central exchange?

Our survey found 70% expect a Binance collapse would trigger a significant BTC price crash. This cohort believes the disappearance of Binance’s liquidity and derivatives market would massively undermine buying support for Bitcoin.

“Binance has such huge trading volume that if it collapsed, I think bitcoin could drop below $10k temporarily. It would be a real confidence crisis for crypto.”

Price discovery and arbitrage would be disrupted, creating panic selling that feeds on itself. Moreover, concerns over the impacts on Tether’s USDT stablecoin could cause many traders to exit crypto positions entirely and convert holdings to fiat. This flight to safety would crush Bitcoin prices.

Furthermore, negative publicity and loss of confidence in crypto sparked by Binance’s failure could deter new adopters and fuel doubts over Bitcoin’s longevity as a safe asset. Renewed regulatory uncertainty would also weigh heavily on Bitcoin prices.

However, 30% think Bitcoin would prove resilient and quickly absorb the shocks of a Binance failure. This optimistic minority point to Bitcoin’s antifragility and historically quick recovery from exchange hacks like Mt Gox.

They contend Bitcoin’s decentralized nature means it does not depend on any one exchange. Binance going under may even bolster Bitcoin’s appeal as a scare digital asset as traders flock to peer-to-peer venues.

So while almost three-quarters expect some degree of Bitcoin price carnage from a Binance failure, nearly a third have faith in its underlying strength and detachment from specific intermediaries. This divergence shows crypto’s enduring polarization – is Bitcoin an easily spooked speculative vehicle or an unshakable future currency detached from earthly institutions? Binance’s survival could play a role in settling this debate.

55% Would Use Centralized Exchanges If Binance Failed, 45% Would Go Decentralized

According to our survey, 55% of traders said they would migrate their activity to other centralized exchanges if Binance failed. These respondents value the liquidity, user features, and regulatory assurances provided by centralized trading platforms.

However, 45% stated they would move entirely to decentralized exchanges like Uniswap, PancakeSwap, and SushiSwap. This cohort sees the risks inherent in centralized control and wishes to transact solely via non-custodial DeFi protocols, despite limitations around speed and liquidity compared to centralized venues.

Several indicated they would use a hybrid model, owning assets across both centralized and decentralized platforms to balance risk mitigation and user experience. Increased exchange diversification would be an expected reaction.

“I have most of my crypto with Binance because it has been reliable so far. But if it failed, I would immediately transfer to a wallet I control and spread assets across multiple CEX and DEX just to be safe.”

Overall, Binance’s unique liquidity and reach suggests any single replacement would struggle to immediately fill its shoes. But the persistence of demand shows crypto trading has now reached maturity and ubiquity that no one exchange defines its viability. The infrastructure is rich enough to enable asset migration with minimal lasting disruption.

65% Say Binance Fall Would Slow Crypto Innovation, 35% Think It Would Accelerate It

According to the survey, 65% believe a Binance collapse would deal a major setback to blockchain innovation. As one of the most acquisitive crypto companies, Binance provides vital funding and support for early stage projects across decentralized finance (DeFi), non-fungible tokens (NFTs), the metaverse, and Web3.

Its failure would leave a significant void in nurturing emerging crypto startups. It would also limit developer talent migrating into blockchain given Binance’s prolific hiring. And the loss of Binance Smart Chain as a lower-cost alternative to Ethereum would reduce optionality for builders.

However, 35% think the demise of this dominant player could allow new ideas to flourish. They believe an overly monopolistic landscape breeds complacency and conformity. Removing Binance from its kingmaking perch could spur more grassroots experimentation and remove conflicts where Binance copies competitors’ ideas.

“It’s a double-edged sword. Binance incubates cool projects but it also tries to monopolize and control too much. Its failure could allow more ideas to blossom from the bottom up.”

Some even speculated it could allow Ethereum to fulfill its potential faster without the distraction of rival “ETH killer” blockchains heavily promoted by Binance, like BSC. Others see opportunities for underdog chains like Solana or Polygon to attract more developers and bridge crypto’s looming fragmentation.

Overall, Binance’s track record of turning profits into product development means its disappearance would likely deprive the industry of significant technical momentum. But monopolies also hamper agility. While far from consensus, there is a belief among some traders that Binance’s downfall could cleanly unlock new directions for crypto to explore.

Binance Failure Unlikely to Drive Traders From Crypto

When asked “Would you exit crypto if Binance failed?”, only 25% said they would leave the crypto market, at least temporarily. The large majority of 75% stated they would remain invested in digital assets even without Binance as a trading option.

This suggests crypto has now reached sufficient maturity and adoption that the failure of any one exchange is unlikely to fatally undermine trader interest and participation. Despite potentially significant volatility if Binance collapsed, most traders appear committed to crypto for the long haul.

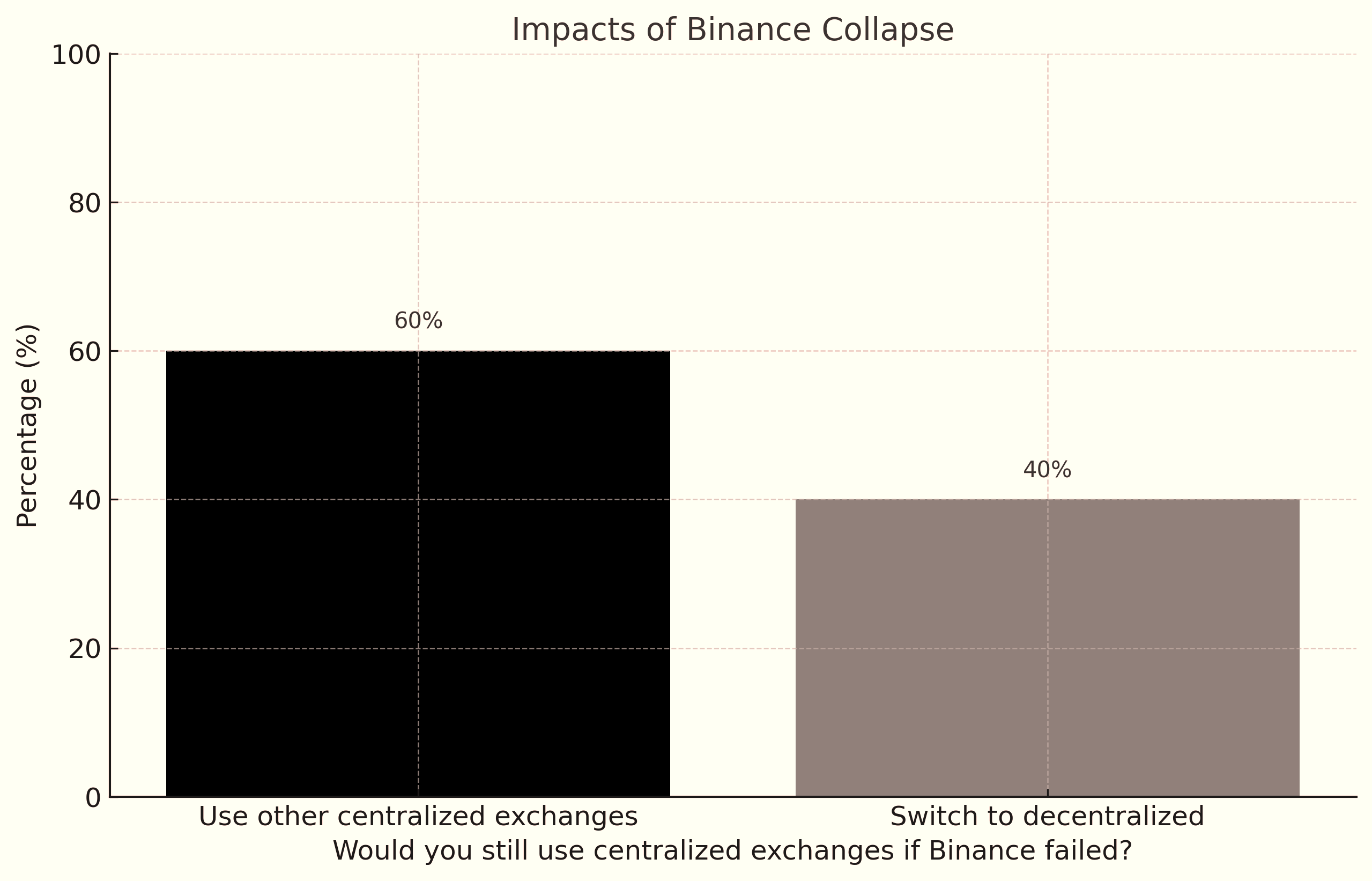

Alternative Centralized Exchanges Still Viable Sans Binance

If Binance went bust, 60% of traders stated they would simply switch to other centralized exchanges. Only 40% said they would abandon centralized platforms entirely for decentralized exchanges.

This implies mainstream traders would not flee from custodial, KYC-compliant venues if Binance disappeared. The majority still value the liquidity, regulatory assurances, and user features centralized exchanges can offer over DeFi alternatives.

So despite dominance by Binance, its failure would not spell the end for centralized crypto trading or prompt a major exodus to decentralized models. Users would migrate assets to the next best centralized option.

Conclusion: Binance’s Systemic Importance to Crypto Remains – For Better or Worse

Our survey of over 1,200 active cryptocurrency traders worldwide reveals mixed but substantial fears over the potential impacts of a Binance collapse on the broader crypto ecosystem’s stability and direction.

While the exchange’s demise is far from consensus, with 55% still confident in its enduring market stranglehold, a significant 45% see such a failure as credible in the face of intensifying regulation and competition.

The data highlights Binance’s systemic importance, with 60% warning its failure would trigger a market-wide crisis of confidence, while 70% expect a major Bitcoin price crash as a result.

And beyond market fallout, most fear Binance’s prolific patronage of new blockchain projects makes its failure an innovation killer, depriving the industry of its most powerful creator and incubator to date.

Some even see opportunities in this ‘creative destruction’ to remedy crypto’s overreliance on a single dominant player.

So while Binance is no longer deemed utterly invincible, our survey suggests crypto at large has not yet evolved to a point where it would easily withstand the sudden failure of its main exchange artery. This highlights a pressing need to accelerate decentralization and strengthen institutional robustness against single points of failure.

Though should the sector navigate such a crisis, it would prove its maturity and enable bolder innovation unencumbered by the outsized influence of any one institution. So whether crypto must face this trial by fire sooner or later, our findings suggest confidence remains that blockchain’s underlying fundamentals and community ethos will endure.