The amount of Bitcoin held in addresses tied to over-the-counter (OTC) desks, seen as a measure of institutional activity, has decreased to its lowest level since June 15. As of Thursday, the OTC desk balance was 5,138 BTC, approximately $150 million at the current market price of around $29,200 per BTC. This marks a 33% decline from the one-year high of 7,697 BTC at the end of June, according to data from Glassnode.

Source: Glassnode

During the first half of the year, the OTC desk balance increased by 156%, coinciding with an 84% rise in Bitcoin’s market value. This increase was seen as a bullish sign, indicating growing interest from institutions and large investors in Bitcoin.

High-volume traders and institutions use OTC desks to avoid affecting the market price of the asset. These desks facilitate direct trade between two parties, with the desk acting as an intermediary. The OTC desk balance has been associated with miners’ intentions to accumulate or sell their coins in the past.

However, drawing definitive conclusions from changes in the OTC desk balances may be challenging due to address-labeling issues. Moreover, the ratio alone does not indicate whether the desk is accumulating or liquidating coins on behalf of its clients.

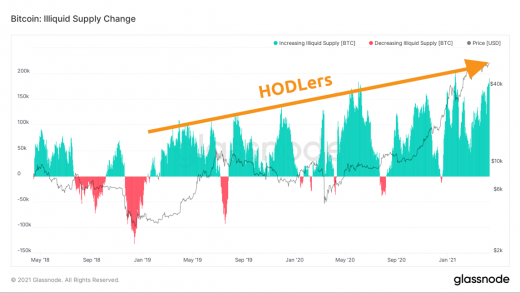

In a recent report by Todayq News on July 12, 2023, Bitcoin has experienced positive performance, with declining exchange inflows and a significant decrease in its balance on exchanges. According to the previous data, the balance on exchanges has reached its lowest point in 5 years, standing at 2,249,389.489 Bitcoins. It was also observed that investors were accumulating Bitcoin at a pace, with a speed of accumulation at +27,100 Bitcoins per month.

Additionally, the number of new Bitcoin addresses has reached a three-month high, indicating growing interest in the cryptocurrency. Bitcoin is providing investors with relief and optimism. Furthermore, the surge in new Bitcoin addresses has reached a three-month high, surpassing previous records, indicating a growing interest in the cryptocurrency. © Todayq News