A recent report by the Bank for International Settlements (BIS) raises concerns about the allure of crypto assets in emerging market economies (EMEs).

These digital assets have been championed as economical payment solutions, gateways to the financial system and even alternatives to national currencies in nations grappling with rampant inflation or exchange rate volatility. However, the BIS suggests that crypto assets might exacerbate rather than alleviate financial risks in these economies.

The report suggests that these assets should be scrutinized just like traditional assets when it comes to risk and regulatory issues.

The findings come from extensive collaborative efforts initiated by BIS member central banks in the Americas under the Consultative Group of Directors of Financial Stability (CGDFS). Central banks from countries including Argentina, Brazil, Canada and the U.S. participated in the effort, with BIS’s Americas Office taking the lead.

Multiple risks

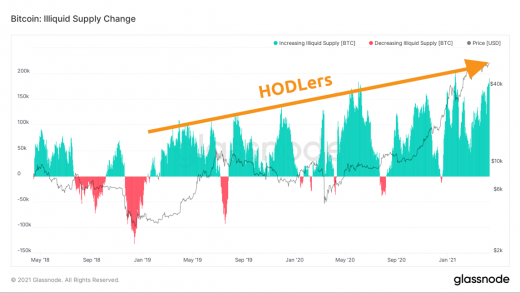

Diving into the specifics, the BIS report identifies multiple risks associated with crypto assets. The liquidity risk, for instance, is heightened by vulnerabilities such as centralized trading on big exchanges, unstable coin reserves, susceptibility to investor runs and operational constraints linked to the “scalability trilemma.”

The study further outlines market risks resulting from crypto asset price volatility and lack of transparency. Direct market risk is attributed to holding crypto assets like Bitcoin. Credit risks are also prominent, with concerns about weak governance, limited investor protection and the excessive leverage employed by some actors in the space. A noteworthy point was the potential risk of bank disintermediation. A significant migration from bank deposits to privately issued digital assets could disrupt credit facilitation by banks.

Balanced approach

Notably, the report highlights the importance of a balanced approach to regulation. Outright bans or restrictive regulations might push these activities underground, making it more challenging to influence the industry’s responsible stakeholders. New innovations should not be dismissed as “risky” solely because they differ from traditional systems. Instead, the report champions harnessing technology and innovation to refine financial systems.